Instructions

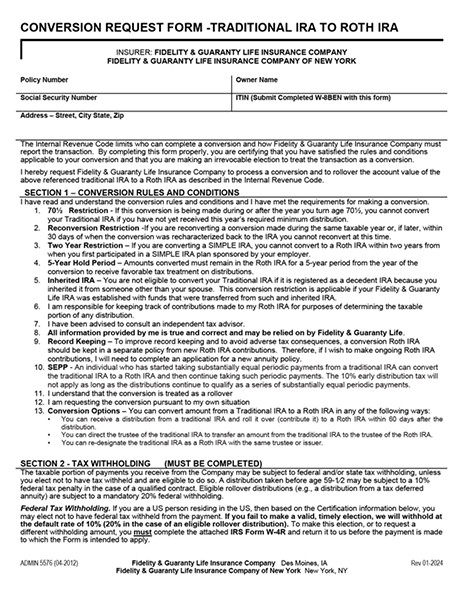

Convert your traditional IRA to a Roth IRA by completing the form on this page.

- Complete form

Provide information according to the instructions on the form. - Fill out requirements

Complete owner name, policy number, owner social security number, effective date, tax option, owner signature and date. A conversion from a traditional IRA to a Roth IRA is subject to income tax; we recommend you consult your tax advisor. - Submit form

Return the completed forms with any required documents via postal mail, overnight mail or fax to our service center.

Postal mail

F&G Service Center

P.O. Box 81497

Lincoln, NE 68501-1497

Overnight mail

F&G Service Center

777 Research Drive

Lincoln, NE 68521

Fax

Annuity Policyholder Services (PHS): 402.328.2266

Allow 3 business days for faxed documents to enter our processing system. - Allow 15 days to process

F&G will process the request within 15 business days of receipt of all required information if in good order. - Confirmation

A confirmation of this change will be mailed to the owner's address on record upon completion.

Conversion Request Form [ADMIN 5576]

Download ADMIN557622-0084